Leverage your Lending Technology with Industry Intelligence

Better with Abrigo

Benefits

Drive efficiencies

Surface relevant content

Boost credibility

Features

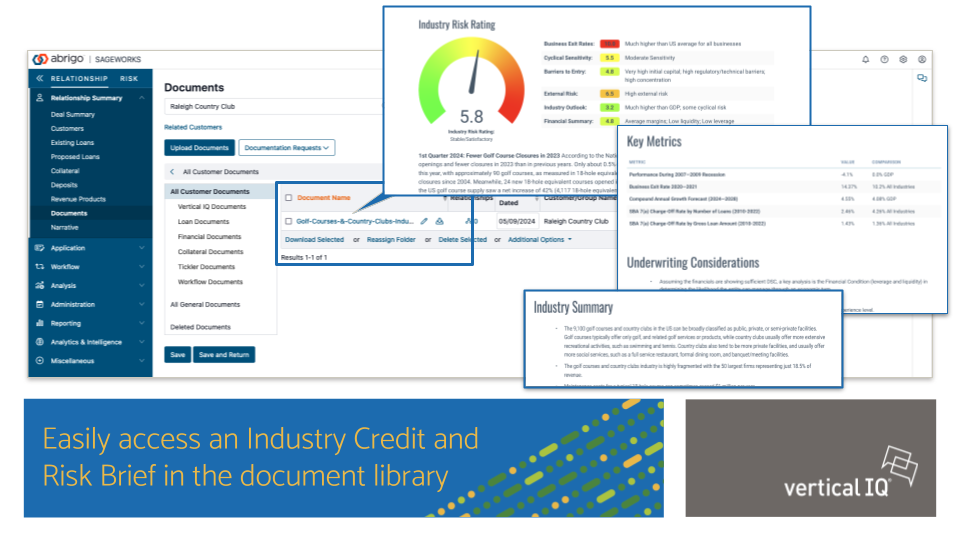

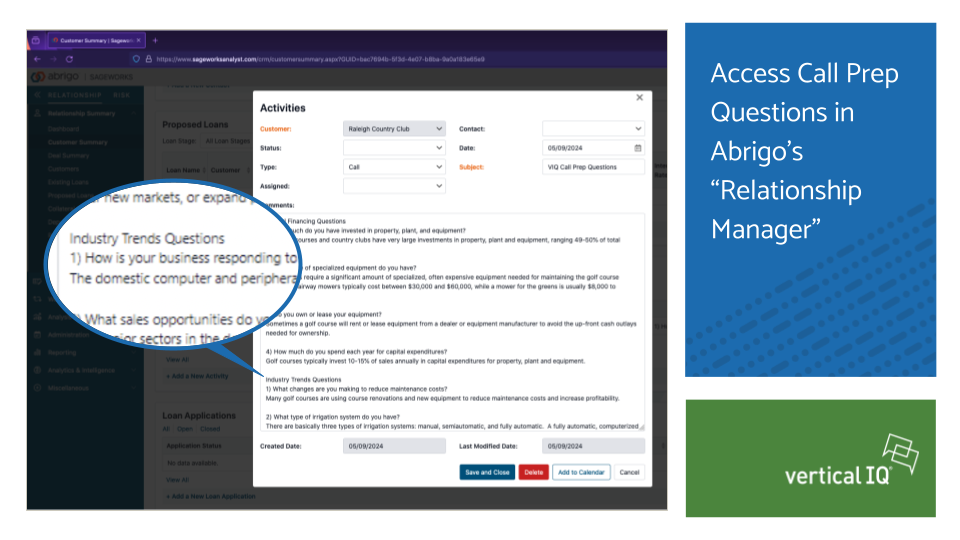

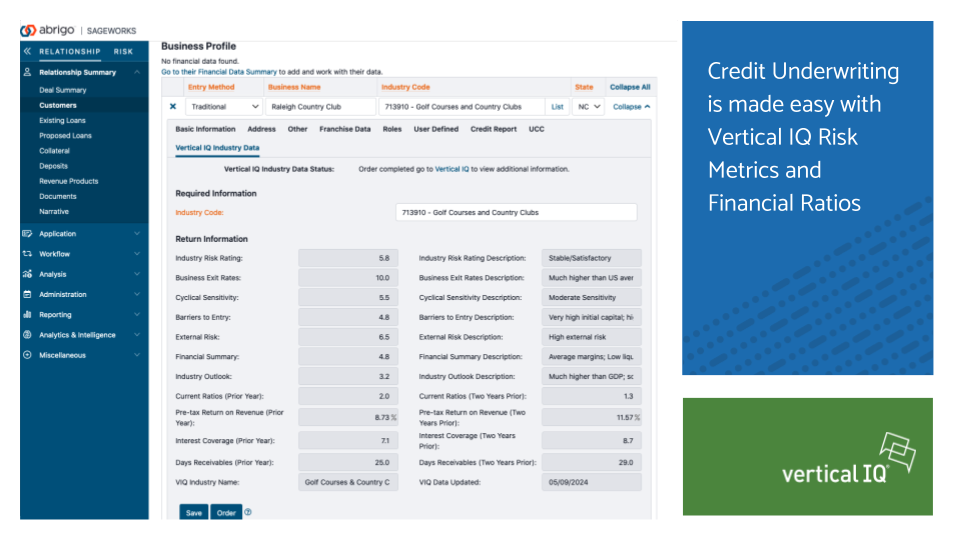

Credit Underwriting and Risk

Financial Benchmarks

Localized Industry Data

Testimonials

Vertical IQ helps us deliver greater value

to our business customers by reducing time spent navigating through the clutter we often encounter when researching business trends and characteristics — we’re more effective in the field which equates to greater mutual success.

Lori Dufficy

Chelsea Groton Bank

quote marks

I use Vertical IQ almost every day. It helps me verify what I think I know and gives me a consistent, dependable resource to reference. … It's made my job a lot easier, and it’s kicking my write-ups and annual client reviews up a notch for sure.

Peter Kovago

Cornerstone Bank

I like that we can now see what's really happening with an industry in our specific area. Vertical IQ’s Localized Industry Data allows us to drill down deeper and to have even more of that local focus to figure out exactly what will benefit our customers — which, of course, also benefits the bank in the long run.

Julie Martin

Claremont Savings Bank

One thing that really made Vertical IQ unique and stand above their competition was the fact that their information is timelier. That’s really key, especially on the credit side.

Megan Allustiarti

HomeTrust Bank

.png)

.png)